“I think of the lab as an information system in its essence,” said Alastair “Ali” Dunnett, Director, Laboratory, Carle Health, based in Urbana, Illinois. As a medical technologist by training, Dunnett says he has a strong interest in informatics and works to get the most value out of his lab’s information systems. He stated:

“This is my 35th year in healthcare and I find it to be an exciting time if you’re interested in informatics, as we now have the horsepower, software, and clever people who are figuring out how to integrate disparate pieces of information. The lab has far more useful information than people realize. If you really get the hood up, there’s quite a lot in there you can use to answer questions and gain insight.”

To understand how lab teams are leveraging their systems and data to measure performance and make improvements, Medical Laboratory Observer issued its second annual State of the Industry (SOI) survey on clinical data analytics.

The majority of those surveyed this year are employed in a lab administration position (69%), with nearly half being lab managers, administrators, or supervisors (47%); 12% lab directors; and 9% section heads or department managers.

Most work in hospital labs (63%), one-quarter (25%) in independent labs or physician office labs, with the others spread out across other categories of facilities (e.g., group practice, government/public health, medical school/MedTech, etc.).

There was broad representation across lab sizes and volumes, with 22% working in labs with 1–10 employees, 10% in labs with 11–20 employees, 19% in labs with 21-50 employees, 25% in labs with 51–100 employees, and 24% in labs with more than 100 employees. Respondents were fairly equally distributed across labs performing from 1,000,001 to over 2,000,0000 tests per year (35%), 100,001 to 1,000,000 tests per year (35%), and less than 100,000 tests per year (29%).

For a qualitative assessment, MLO also interviewed medical lab professionals and technology providers on the topic of clinical data analytics, specifically challenges and opportunities around process automation, data capture and planning and forecasting.

Laboratory information system (LIS) platforms

There was little change since last year when it comes to the type of laboratory information systems (LIS) medical lab professionals report to be using, with 39% using stand-alone systems (38% in 2022) and 61% modules within enterprise-wide electronic health record (EHR) systems (62% in 2022).

There was a slight increase in those using cloud-based LIS infrastructure (28% in 2023 compared with 24% in 2022), while the majority still use in-house software/servers (73% in 2023 compared with 76% in 2022).

Electronic processes in the LIS

When asked what functions were electronic through their LIS solutions, electronic orders and results (87%) and integration with analyzers (71%) topped the list. More than half of respondents said they had electronic billing/revenue cycle management (56%) and QA/QC (52%) processes.

About one-third said they have electronic processes through the LIS for regulatory compliance/reporting (31%), point-of-care testing (POCT) management (34%), and scheduling (31%). Fewer had moved from manual to electronic processes for inventory control/supply chain management (17%) or customer service (15%).

“Prior to 2017, our only computer system was to make patient appointments. Everything in the lab was on paper forms that then were given to the physicians and eventually pasted in the patients’ charts. In the fall of 2017, our two clinics along with other small clinics in the area bonded together with a hospital in town and we had Epic installed in computers in our clinics.”

Caswell explained how schedules and lab orders are processed through Epic, with orders then released into their LIS. They manually enter all other tests into the LIS, which are then transferred into patients’ charts in Epic.

“Because a lot of our lab tests are waived tests, I don't see any more tests being electronically resulted in our LIS,” said Caswell. “Through the LIS, all our hematology controls are kept within the system, and we are able to pull up Levy-Jennings charts for our controls. We are also able to bring up test volumes and other pertinent information that we need.”

“Implementing electronic processes is vital if the lab has any significant operational volume and if it is looking for efficiency to retain and keep its current customers happy, plus has plans to grow its customer base, expand its test menu, and increase throughput,” said Suren Avunjian, LigoLab CEO.“Human intervention in the laboratory and manual workflow can only take you so far before the potential for mistakes and bottlenecks become major issues and threats to the business,” he added. “Modern laboratories eliminate this risk by automating core processes and introducing interoperability with analyzers, EHRs, and third-party services like billing companies.”

“Automation is not only incredibly more efficient, but it is more effective,” said Marci Dop, VP, Enterprise Laboratory Operations, ELLKAY. “An automatic patient matching process could be looking at 20 or more criteria to ensure an accurate match, whereas a manual process would not evaluate that many criteria. Imagine if your lab was able to reduce the number of duplicate registrations generated from processing blood in a bag.”

Interoperability and data integration challenges

While automation is key to greater efficiency and accuracy, over half of survey respondents (51%) said interoperability and data integration issues with other LIS or EHR are a stumbling block to implementing electronic processes at their labs. This was up from 46% in 2022.

The Carle Health lab team performs 3–3.5 million tests annually, serving collaboratively 600–700 beds in a community of 1.2 million patients. As Dunnett explained, they are not new to information systems, having total lab automation with integrated modalities across coagulation, chemistry and hematology. Yet he acknowledged how data integration and system operability continue to be a major challenge in the lab industry because of the “niche or narrow solutions” that have been introduced over the years.

“Lab teams have long been responsible for pulling together islands of information,” explained Dunnett. “For many years we have used a tool for reporting some analysis. It helps with turnaround times (TAT), volume statistics, activity reporting, and productivity (staff and instrument – for capacity management). But it’s still essentially a very static tool that has its limitations. Now that we have total lab automation, we can consolidate more information so we can look at things more broadly across the board. A significant evolution but not where we ultimately want to be.”

“The lack of standardization across various systems presents a unique challenge to labs,” said Dop. “Even within the same health system, there are labs operating on different systems. This disparity makes interoperability between systems difficult and makes the use of machine learning imperative.”

Clifford said labs are often challenged with being able to implement electronic processes for two main reasons, in her experience. One is they approach the process by trying to mimic their current, manual processes and workflow, as she explained:

“In this situation, they are missing the point — and the benefits — of technological advancements and automated, electronic workflows. The point is to optimize workflows and break out of the tedious, manual often outdated processes, not to re-create them by simply automating it.”

“Lab management or project managers should be taking the opportunity to take a step back, analyze the capabilities of the technology, and determine how they can best leverage these to leap outside their current norm,” Clifford continued. “Often, the vendors you are working with will be best able to guide you on the benefits and intended workflow or implementation of these solutions, ensuring that you achieve the optimal outcome and ROI. If they can’t, they may not be the right technology partner. Another option is to hire a consultant with expertise in technology and optimizing workflows. This can be beneficial if you are struggling with internal politics, thought processes, or simply with being too close to the situation to see the bigger picture.”

Clifford noted how having many different functional areas involved in the process is another challenge labs face when trying to implement electronic processes:

“There are often conflicting objectives from different departments and functional areas. These can create a situation where personalities are at play and the business objectives aren’t necessarily the focus. It is essential that key objectives are met for each functional area, but these should be clearly defined (e.g., security, access, user rights) but be careful not to involve the ‘how’ in the discussions. By clearly defining the requirements and the goals, then the core functional area (the lab) can define what they need and how to achieve it while meeting the key underlying needs of other areas.”

Avunjian cautions labs to avoid adding multiple vendors and multiple electronic systems as this approach won’t necessarily solve the interoperability and data integration barriers that exist. He stated:

“Instead of multiple systems and bolted-on modules, lab managers should seek out laboratory information system vendors that offer all-in-one solutions and one source of truth for all laboratory informatics. This is the only way to achieve the desired end-to-end data integrity and maximized connectivity. Examples of this all-in-one approach are LIS systems that feature interwoven modules and interface engines that share the same software structure, and that have the support of expert teams of interface engineers.”

Data analytics for operational performance

While only 12% of lab professionals surveyed said they are utilizing data analytics for all aspects of their operations, a deeper dive into the responses reveals overall greater interest in analytics capability improvements. Nearly half of those surveyed (49%) said they are utilizing data analytics for some aspects of their operations and planning more, up from 42% in 2022. Among those who have not yet used data analytics in any significant way, 23% said they want to start, up from 16% in 2022.

Only 6% of respondents said they are not using data analytics and have no plans to start soon (down from 16% in 2022). Additionally, 10% said they are utilizing data analytics for some aspects of operations and not planning more (up from 8% in 2022).

Independent Consulting Lab Director Martha Casassa said none of the organizations she has worked for in the past three years as a Traveling Director had instituted a formal analytics program.“Laboratory-specific metrics are pulled on a monthly basis primarily manually from the LIS,” she explained. “I have not seen analytics modules offered by LIS vendors. Most often, they are third party software layered over an LIS. Analyzer middleware will provide some analysis, but only for the data they are handling — not for the entire lab.”

“Some newer installations (within the past few years) offer dashboards providing limited analytics,” she continued. “Much of the analytics software available has been third-party originating primarily for those laboratories performing a high volume of outreach testing and needing to monitor performance for their customers. More recently, instrument vendors are offering analytics through their middleware. However, the output is constrained to the data coming through the middleware. The software is not integrated to pull data from the LIS to provide whole-lab analytics. While helpful, these available systems provide a limited view of the laboratory's operations.”

Among respondents with data analytics tools, 69% said they were integrated with the LIS (up from 65% in 2022) and 31% said they use a separate tool (down from 35% in 2022). With regards to how often the data for analytics is refreshed, 32% said weekly, 31% in real-time, 28% daily, 5% in minutes, and 3% in hours.

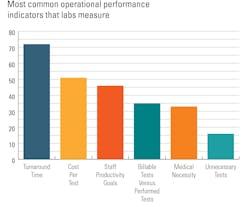

The most common operational performance indicators that labs measure according to the survey results are turnaround time (72%), cost per test (51%) and staff productivity goals (46%), followed by billable tests versus performed tests (35%) and medical necessity (33%). Indicators for unnecessary tests was lower down on the list at 16%.

“As labs become more aware of the possibilities offered by data analysis, we’re seeing an increased number of requests from labs looking to gain access to their data in a consumable and actionable format. But we’ve found that very few labs are confident in their ability to extract data from the LIS, manipulate the data, and to implement protocol changes to improve workflow,” said Jennifer Sanderson MS, CTT+, MLS(ASCP)CM, Sr. Global Marketing Team Lead, Workflow Solutions, Siemens Healthcare Diagnostics. “As such, we’ve been acting in a consultative role in most instances where operational performance is concerned, assisting with data assessment, and later determining and implementing operational improvements to improve workflow protocols.”

She shared success stories from labs that have implemented analytics programs, like Atellica Process Manager, in developing new protocols to make staff and testing processes more efficient. One customer reconfigured their testing protocols using reagent efficiency data from Atellica Process Manager, resulting in annual operational savings of more than $50,000. Another Lab Director, in this case in a community hospital lab, determined they could eliminate the lab’s urgent care testing station and POC devices with a few changes to workflow and testing protocols.

“In several instances, we’ve seen other labs dramatically reduce repeat testing, significantly improve TAT and labor efficiency, and realize notable cost savings by limiting reagent waste, among other improvements,” said Sanderson. “In the future, we expect additional operational enhancements to be realized by artificial intelligence. There is great potential for data to more profoundly enhance tube routing, sample stops, and other workflows based on aggregate historical performance data.”

Over half (54%) of survey respondents said they are tracking the number of tests performed specifically for COVID-19, while only 17% said they tracked the number of tests performed for influenza.

More than half (54%) also track positive and negative test results for COVID-19 (up from 42% in 2022). In fact, reported tracked metrics for COVID-19 were up in all categories queried in the survey:

- Turnaround time 38% (21% 2022)

- Types of tests performed 31% (3% 2022)

- Supplies used/inventory management 29% (8% 2022)

- Cost per test 21% (3% 2022)

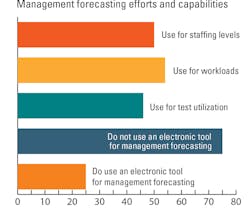

MLO questioned lab professionals about their management forecasting efforts and capabilities. Half (50%) use forecasting for staffing levels (down from 55% in 2022), 54% for workloads (down from 57% in 2022), and 46% for test utilization (down from 68% in 2022). Three-quarters (75%) said they do not use an electronic tool for management forecasting, while 25% said they do.

“I don’t think (management forecasting) is something labs can do on their own. That’s one of the big problems,” said Dunnett. “Lab vendors come to me and say, ‘I can help with lab utilization’ and candidly they can’t. What they can do is produce reports telling us what was performed, which I call ‘activity reporting’ but you can’t guide decisions until you get upstream from the lab for insights into the patient’s condition and context for the clinician’s decisions. What we need is a lab, electronic medical record (EMR) and prescriber partnership solution.”

Dunnett noted how a hospital’s business intelligence team typically does not want the kind of granular level detail that the lab needs to satisfy its own operational needs. “We give them the tip of data iceberg, the rest of it is what we use in the department for operations and management,” he explained.

To dig deeper into lab data for meaningful reporting, Dunnett said his lab has employed a team member specialized in structured query language who has access to the data layer in the EMR and lab system.

“The beauty of having that SQL writer sit between the two systems is she can pull granular detail that we never dreamed of having and never programmed or planned to give to the EMR,” Dunnett continued. “She can juxtapose it alongside our data to answer a question, which is what it’s all about.”

Dunnett says they can create reports that include a patient’s data from the EMR so they have richer detail on their condition and history. Next, they put it alongside the frequency of ordering certain tests to see if there is pattern to how tests are utilized in the management of that type of patient.

Looking ahead

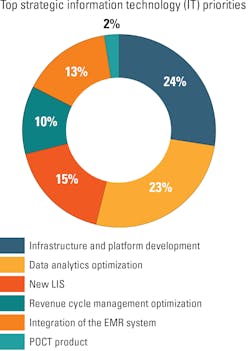

To understand how lab professionals are preparing for the future, we asked for their top strategic information technology (IT) priorities for their organizations in the next three years.

The results were similar to last year’s survey, with infrastructure and platform development (24%) and data analytics optimization to support lab management (23%) highest on the list, followed by new LIS (15%), revenue cycle management optimization (10%), and integration of the EMR system (13%). POCT product was the least selected priority (2%).

Among the 12% selecting “other,” several cited HER-related initiatives, including the implementation of a new EHR system, transition from one EHR platform to another, and EHR/LIS optimization. Others stated they were upgrading their LIS solutions, and one respondent said they were automating the validation of lab results.Avunjian said accessioning client orders is at the top of the list for labs when it comes to automation:

“Moving from manual order processing to an electronic interface directly translates to more efficiency and productivity because it eliminates typographical errors, increases throughput, and improves turnaround time. We also see many of our lab partners moving toward electronic processing to support automated billing, digital pathology, the automatic assignment of cases to pathologists, and the automatic assignment of case numbers based on factors like the client, physician, location, and test type.”

Dop believes the inbound registration and order process should be one of the top priorities for a lab that is still manually processing laboratory requisitions. She stated:

“When a lab has specimens coming in from outside the organization without automation, they are registering patients in the systems manually and then also manually placing the orders. This leaves room for errors with faulty patient matching, incomplete or incorrect insurance information, or even just misinterpretation from bad handwriting. When patients are registered electronically via inbound interfaces to the laboratory, the system matches the patient or creates a new one in seconds, it files their insurance information and passes the order to the LIS. This frees up staff time on the pre- and post-analytic side of processing the specimen.”

Dop said once labs are beyond automation of patient registration and ordering, she sees electronic compendium standardization becoming a trend in the lab market.

“The healthcare industry still does not have standard nomenclature for tests across EHRs, practices, insurances, etc., so every one of a lab’s clients may call a test by a different name,” Dop explained. “Many of our partners have listed this challenge as a key inhibitor in their workflow. For example, a clinician orders a CBC. This shows up as a hemogram in another system, another system may type is out as complete blood count, or just abbreviated as a CBC.”

“In the absence of a standardized compendium, machine learning and test code mapping will be key to allow for these multiple iterations to be identified as the same test,” she added. “When this identification can be done automatically, this allows the order to flow from one system to another without manual intervention. Without automation, more staff are required on the front end of an order to interpret and process orders.”

Lab professionals who took part in the survey also weighed in on the challenges faced in their planning and forecasting environments in the next three years, rating the following factors on a five-point scale: funding, staffing, technology, training, ROI/costs, with “1” being the most challenging and “5” the least challenging.

Looking at the most challenging factors in terms of those that ranked highest as a 1 or 2 on the scale:

- Staffing was at the top of the list at 85% of respondents ranking it as a 1 or 2 (down from 91% in 2022)

- Funding at 56% (up from 49% in 2022)

- ROI-costs at 24% (down from 41% in 2022)

- Training at 19% (down from 38% in 2022)

Dop said resources remain a challenge for labs across the country, noting how they are being required to provide more data and information without additional resources to gain access to that information. She commented:

“The implementation of electronic processes is not just an investment for the lab, but it is also an investment of staff time and resources. It can be a difficult sale to leadership to make the investment of moving from manual to electronic processes due to what is required to make it happen. However, no matter which processes are moving away from manual, labs will see the return on investment in increased reimbursements, an improved workflow for staff, and efficiency gains that we have seen reduce the need for a number of FTE in many cases.”

Casassa noted how IT security and hospital budgets are typically not favorable for third-party packages; therefore, it is incumbent upon LIS vendors to develop modules that are integrated into their existing software and can provide whole-lab data with drill downs available by specialty section (i.e., chemistry, hematology, microbiology, etc.).

“They need to adopt the middleware concepts and expand on them,” she explained. “Outreach systems may still be required as the monitoring and metrics provided are distinct for the outreach business. Laboratory leaders need basic day-to-day operational metrics on a real-time basis to optimize sample processing and workflow, analyzer usage and needs, and especially staffing in light of the industry-wide shortage of laboratory scientists. Customized current dashboards of key metrics should be available to all levels of laboratory leaders.”

She concluded: “Directors, managers, supervisors, schedulers, etc. should be educated in their use for more eyes on the data providing more opportunities to improve — the goal of analytics.”

About the Author

Kara Nadeau

has 20+ years of experience as a healthcare/medical/technology writer, having served medical device and pharmaceutical manufacturers, healthcare facilities, software and service providers, non-profit organizations and industry associations.