Molecular diagnostics (MDx) testing expands while lab supply shortages shrink

The molecular diagnostics (MDx) market is estimated to be worth $16.6B in 2023, and expected to reach $28.6B by 2028, as “Rapid progress in technologies such as next-generation sequencing, gene editing, and personalized medicine will drive increased adoption of molecular diagnostic tests.”1

To reflect the broadening availability and use of MDx testing, and a shifting focus from COVID-19 testing to other applications, the 2023 Medical Laboratory Observer (MLO) State of the Industry (SOI) survey on molecular diagnostics (MDx) featured some new questions and expanded response categories designed to identify emerging trends.

As in past years, the survey queried lab professionals on MDx testing volumes and quality assurance practices. We also retained questions related to supply chain challenges and excess analyzer capacity to gauge whether there were shifts in these areas since our last survey on this topic in fall 2022.

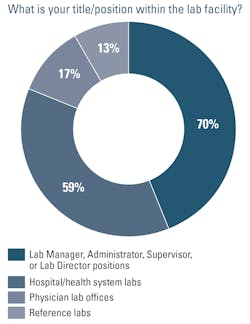

Nearly 100 lab professionals participated in the survey, with the majority (70%) of respondents in Lab Manager, Administrator, Supervisor, or Lab Director positions. This year, we added additional response categories to the place of employment question. While most respondents work in hospital/health system labs (59%), one-third are employed by physician lab offices (17%) or reference labs (13%).MDx testing modality trends

When asked what types of MDx tests they use in their laboratories, topping the list were reverse transcriptase quantitative polymerase chain reaction (rRT-qPCR) with 62% of respondents using these tests, rapid molecular tests (59% of respondents), and rapid antigen tests (43% of respondents).

Among other tests, flow cytometry and next generation sequencing were tied at 18%, DNA/genetic testing was reported to be used by 15% of respondents, 12% use reverse transcription loop-mediated isothermal amplification (RT-LAMP), and 9% recombinase polymerase amplification (RPA). Further down on the list in terms of usage was liquid biopsy at 5% and CRISPR-based diagnostics at 2%.

“And then for other types of patients, such as those who are immunocompromised, transplant, oncology, we have broader syndromic type panels and platforms that go along with those to test for a wide variety of respiratory pathogens, if they have respiratory illness, or gastrointestinal pathogens if they have GI illness,” Dr. Dunn continued. “So, we try to reserve the broader, highly multiplex type of molecular panels for those more medically complex type of patients.”

Qiagen CEO Thierry Bernard shared his insights on MDx testing trends, stating:

“The COVID-19 pandemic has been a catalyst for remarkable advancements in molecular diagnostics, driving widespread adoption of PCR and nucleic acid testing technologies. This unprecedented expansion has opened doors to broaden infectious disease testing and improve global health outcomes.”Bernard described how multiplex or syndromic testing is gaining momentum due to its efficiency and cost-effectiveness. He noted how it is set to become the new standard because it is essential for detecting a wide array of pathogens. He added how multiplex testing is especially valuable for identifying co-infections and tackling the growing threat of antimicrobial resistance. “In oncology, liquid biopsy is revolutionizing cancer detection and monitoring as a non-invasive alternative,” Bernard continued. “Additionally, minimal residual disease testing quantifies remaining cancer cells post-treatment, shedding light on the likelihood of disease recurrence and guiding personalized treatment strategies.” “T-cell monitoring extends beyond PCR capabilities, providing researchers with a deeper understanding of the immune system’s responses to infections and paving the way for cutting-edge therapies and vaccines,” Bernard added.

MDx testing volume trends

With regards to the number of molecular-based tests (non-COVID-19) performed by their labs, daily, the results were quite different from last year, possibly due to a shift in respondent demographics (e.g., lab types). In 2023, 56% of respondents said they performed 0-100 tests each day, down from 75% in 2022, while 23% said they perform 400+ tests daily, up from 5% in 2022.

The other responses held steady over the past 12 months: a reported 101-200 daily tests at 12% (13% in 2022), 201-300 tests at 6% (5% in 2022), and 301-400 tests at 2% (same as 2022).

“The negatives of this transition are 1) people will lose jobs as everything will become more consolidated and more efficient. 2) turnaround time for results will slow down in many cases as big national labs have slower turnaround times than smaller regional labs. The reason for that is that these labs are busier and also have to ship specimens across bigger distances to get tested, screened etc. 3) customer service for clinicians will go down because a) smaller labs cater to their clients, repeat testing easily and faster upon request etc., and b) it is easier to reach someone knowledgeable to talk to at a smaller lab if a clinician wants to ask a question, clarification etc.”

“The positive is that testing may become more efficient,” Manolopoulos added. “That means fewer people or instruments needed to do the work as more testing capacity will be consolidated in certain locations nationwide. That should mean increased profits for the big labs, but will it also translate to savings for the insurance companies and the people they cover? Probably not.”

Quality control trends

The survey questioned lab professionals about their quality control measures, asking how they handle questionable results with MDx tests. Over half of respondents (55%) said they repeat the test, 15% verify all pre-analysis steps are performed correctly, and 8% send results to another lab for verification and second test.

When asked what steps they take to reduce the number of potential false positive test results:

Respiratory testing trends

With the Department of Health and Human Services (HHS) announcing the end of the COVID-19 Public Health Emergency on May 11, 2023, MLO revised some of its MDx SOI survey questions to reflect the shift in testing focus.

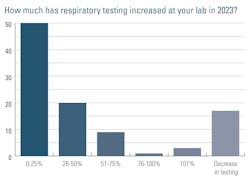

Instead of asking lab professionals specifically about COVID-19 testing volume, we asked how much MDx respiratory testing has increased in their labs in 2023. Half (50%) said their volumes have increased 0-25% since last year, 20% reported a 26-50% increase, 9% a 51-75% increase, 1% a 76-100% increase, 3% a 101+% increase, and 17% said they have seen a decrease in testing.

“We are seeing a continued need for automation and workflow efficiency in the lab to keep up with testing demands, especially during times of high-volume testing coupled with ongoing staffing shortages. Instruments such as our Panther system have a small footprint and the power to consolidate testing on a single, fully automated platform.

“We are also hearing from labs that they need increased flexibility from their instrumentation as budgets for both space and equipment are tight,” Dr. Schneiders continued. “Labs need the ability to perform a high volume of sexually transmitted infection tests or respiratory tests during cold and flu season, for example, while still needing to perform a variety of lower volume tests. We integrated this type of flexibility into our Panther system so labs aren’t required to buy new instruments regardless of assay volume.”

A higher percentage of lab professionals said they have excess capacity in analyzers originally purchased to handle COVID-19 testing compared with last year (66% in 2023, up from 54% in 2022) and fewer said they don’t (34% in 2023, down from 46% in 2022).

With regards to how they are addressing that excess capacity in analyzers, more respondents said they had added new tests to in-house offerings from among those that are currently sent out to reference labs (53% in 2023, up from 46% in 2022) or had retired some analyzers (22% in 2023, up from 10% in 2022).

Alesia McKeown, Ph.D., Scientific Partner, Roche Diagnostics, commented on the opportunities presented by having these analyzers in laboratories.“As we went through the pandemic, we were hit with the realization that labs are severely understaffed and under-resourced. Everybody was trying to get their hands on as many platforms as possible so they could handle even the baseline of COVID needs. Now, at the end of the pandemic, all these laboratorians have all these platforms and are trying to decide what to do with them.

“One of the major obstacles for onboarding any type of molecular diagnostics is having the instrument in house. Now that labs have them on-site, it’s opening the door for them to perform PCR testing for so many other critical disease areas.”

“We are seeing a huge number of people bringing on STI testing. It's also allowing for smaller labs to bring testing in-house instead of having to send out to larger reference labs.

It’s opening up the opportunity for everyone to have this technology for all of the diseases it has been designed to diagnose.”

Supply chain trends

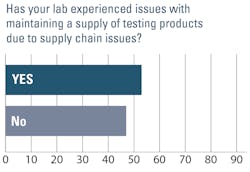

Some of the most significant changes reported in the past 12 months were related to laboratory supply availability. Just over half of those surveyed (53%) said they had experienced issues with maintaining a supply of testing products due to supply chain issues, much lower than the 85% who said they faced this challenge when surveyed in fall 2022. Nearly half (47%) said they have adequate testing supplies to meet testing demands, compared with just 15% last year.

When asked which MDx testing supplies they had trouble sourcing due to supply chain issues, the only category that increased in response percentage was pipettes (25% in 2023, up from 20% in 2022). All others dropped, some significantly, indicating an alleviation of supply challenges in these product categories:

- Blood collection tubes: 27% in 2023, down from 74% in 2022

- Controls/Reagents: 27% in 2023, down from 46% in 2022

- Transport media: 20% in 2023, down from 38% in 2022

- Swabs/Consumables: 19% in 2023, down from 50% in 2022

- Testing kits for SARS-CoV-2: 15% in 2023, down from 43% in 2022

- Winged blood collection sets: 11% in 2023, down from 48% in 2022

- PPE: 9% in 2023, down from 29% in 2022

- Contrast media for radiology: 0% in 2023, down from 13% in 2022

- Cannula syringes: 0% in 2023, down from 5% in 2022

Looking ahead

Among those experts interviewed for the article, some offered their thoughts on the future of MDx testing both in the near and long term:

Alesia McKeown, Ph.D., Scientific Partner, Roche Diagnostics

With the next respiratory season upon us, Dr. McKeown spoke about what she foresees with regards to MDx trends in the coming months.

“Traditionally, respiratory season was referred to as ‘flu season.’ Then COVID came on board and while it does not yet have a clear seasonality, all predictions indicate that it will be circulating this fall and winter So, we have those two players (flu and SARS-CoV-2). Then coming into the last couple of years, there has been greater awareness of RSV. As we move into the winter months, I think we’ll see exactly what we saw last year – those three different pathogens co-circulating at different levels and having very similar symptoms.”

“Many of our customers and key opinion leaders are starting to put a multiplex testing option as their first step in their respiratory algorithm for not just flu, not just SARS, but for all three at once. In my opinion, multiplex is the future, especially for respiratory. Our challenge now is to continue to demonstrate its impact and minimize any reimbursement issues.”

Jim Dunn, PhD, D(ABMM), Director of Medical Microbiology and Virology, Texas Children's Hospital

“We are on track this year to have similar respiratory testing numbers to what we had in 2022. In the near-term I don’t foresee any major changes in how we test for respiratory viruses. We are seeing a slight increase in RSV in our geographic region right now, but how high it’s going to go, we don’t know. And then when is flu going to pop up? There have been unusual and unseasonal patterns of infection with many of the non-SARS respiratory viruses since the pandemic. So, it’s hard to predict.”

Jennifer Schneiders, Ph.D., President of Hologic’s Diagnostics Solutions Division

“The ‘tripledemic’ of COVID, flu and RSV all circulating during the typical cold and flu season will continue to put a significant strain on the healthcare system year after year. Our Panther Fusion SARS-CoV-2/Flu A/B/RSV assay is a critical tool we’ve developed to help clinicians determine which respiratory virus or coinfection patients have so that healthcare providers can better inform the best course of treatment.”

Thierry Bernard, CEO, Qiagen

According to Bernard, AI integration is “revolutionizing molecular diagnostics, enabling rapid, accurate analysis and heralding a new era of earlier disease detection, effective treatment monitoring, and truly personalized therapy.” He explained how AI-driven algorithms identify patterns and biomarkers that traditional methods simply cannot discern.

“AI is crucial in managing the immense data generated by molecular diagnostics, especially in bioinformatics,” said Bernard. “As genetic and genomic data grows in volume and complexity, AI-based systems become essential for processing, analyzing, and interpreting information, streamlining diagnostics and research while revealing new insights into disease mechanisms and therapeutic targets.”

“AI has the potential to bridge the gap between molecular diagnostics and complementary techniques such as imaging – integrating in-vitro and in-vivo approaches for a comprehensive understanding of tumors and enhanced treatment options,” he added.

References

1. MarketsandMarkets Research Pvt. Ltd. Molecular diagnostics market is expected to reach $28.6 billion. MarketsandMarkets Research Pvt. Ltd. Published July 27, 2023. Accessed September 27, 2023. https://www.globenewswire.com/news-release/2023/07/27/2712169/0/en/Molecular-Diagnostics-Market-is-Expected-to-Reach-28-6-Billion-MarketsandMarkets.html.

About the Author

Kara Nadeau

has 20+ years of experience as a healthcare/medical/technology writer, having served medical device and pharmaceutical manufacturers, healthcare facilities, software and service providers, non-profit organizations and industry associations.